“Ignorance is bliss,” is a phrase you often hear people say when it comes to certain aspects of life. I am guilty of that mindset myself, especially when all the world seems to focus on is the negative aspects of what’s going on. However, when it comes to your business, one should never think that ignorance is anything but trouble. While you can’t take be all things at all times, you can’t let yourself fall behind in any aspect of your company when it comes to something as important as your company’s cashflow avenues.

Many entrepreneurs make the unfortunate mistake of looking and understanding their different streams of cashflows too late. If you are new to the entrepreneurial world, right in the midst of it, or have been a long-time business owner, you can always learn a thing a two on how to manage the different cashflows that can affect the success of your business.

The first five years are the real true test to a business’s longevity and its ability to make it or break it in their industry. That is why it is important to understand the different ways to effectively and proactively keep your business healthy while seeing a profitable cashflow year after year. Let’s take a look at some of the different business cash flows that will help any entrepreneur in the beginning steps of this exciting journey.

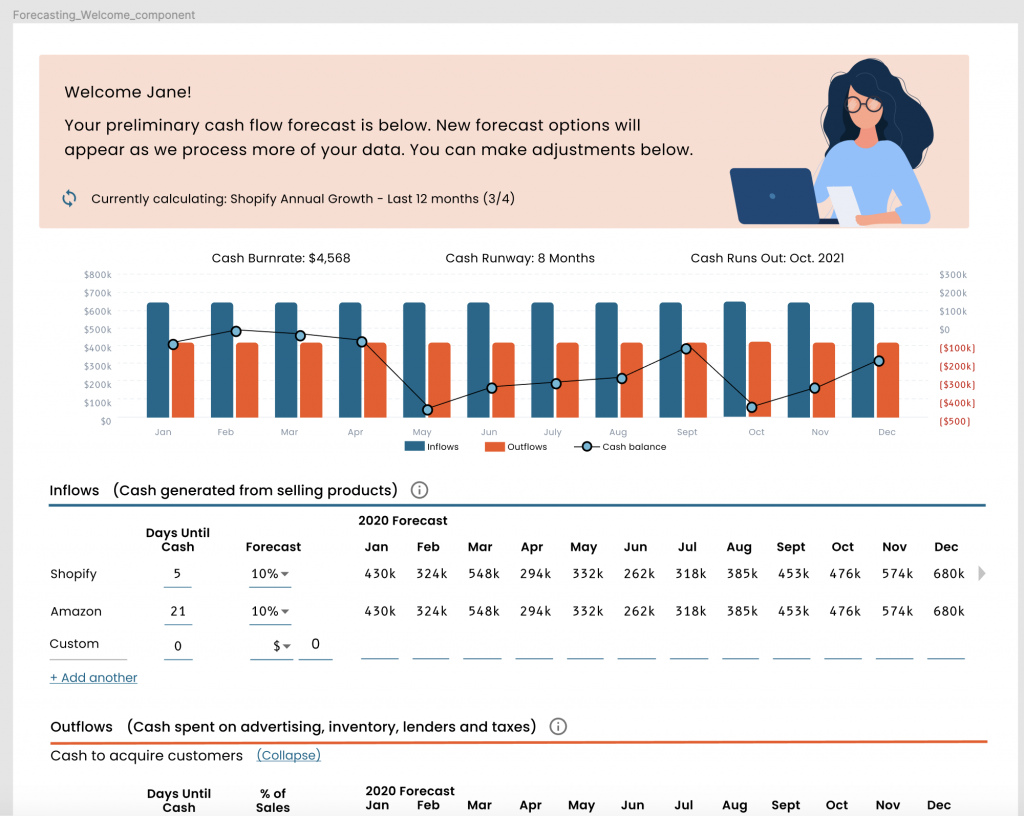

Brightflow AI is a brand new product that enables you to easily and quickly see your cashflow and empower you to make important decisions with that information. They have helped identify some of the leading ways that you can keep your finger on the pulse of your business’s most important asset: your cash.

For example, offering pricing that is way below the market value of a product can be hugely detrimental to a company’s cash flow. While it’s one thing to be competitive, it’s another to make it so low that it can’t adequately fund the products and services that you are offering.

Poor pricing of products or services, which results in lower margins and profits, can create cash flow issues if you have inadequate funds or working capital needed to pay off expenses. You need to know the underlying cashflow in order to make good decisions.

Another example is the choosing between hiring people to help your company, or putting your company on a hiring freeze to conserve your cash. “When businesses run low on cash, they tend to postpone hiring resulting in an understaffed business which ultimately negatively affects the quality and punctuality of services, further resulting in lower sales,” according to Brightflow AI. If you ever heard the saying, “you trip over dimes to save pennies,’ then this example highlights this quote perfectly. While you may think that you are saving money by not hiring more people, you could actually be doing more harm than good, and potentially costing yourself more money in the long-term.

So how do you fix these problems and get your cashflow moving in the right direction?

Here are five examples of what you can do to proactively get your business in the right direction of successful longevity.

1. Use a smarter tracking tool

This is instrumental, and yet, I think many people find it tedious and a lot of work. Spending a lot of hours in Excel and corralling stacks of reports from your QuickBooks via your bookkeeper takes time away from critical business operations. You want to know if your company is making money; but tracking all of the company’s profits and losses to get an accurate picture of what’s really going on is time and effort. For companies that close their doors early, it’s often because they didn’t monitor their cashflow often enough. Most companies only check their cash flow at the end of every month, at which point most cash flow problems are much harder to fix.

Brightflow AI is here to help you not only understand your business’s cash flow, but also will also automatically track your sales and expenses, and educate you, the business owner, in a way that is simple and understandable.

In survey data from Brightflow AI, “the biggest problem with hiring accountants for this job is that they are more reactive than proactive. Additionally, they fail to educate business owners about the state of their finances and guidance for the future.” However, Brightflow doesn’t have this shortfall. Instead, they offer a product that is not only user-friendly but also makes financial metrics interpretable for entrepreneurs with little to no financial experience.

For those who are done spending too much time in Excel or worried that they need to understand cashflow better, we’ve partnered with Brightflow AI to offer Free Access to StartUp Mindset readers by using this link.

2. Predict slow inflow periods

I think we have all heard people say, “this is our slow time.” In most industries, your slow periods usually come like clockwork so it’s best to be prepared for those ‘slow times.’ In the months you are busy, set some of the money aside to help cover the expenses during the slower months you know are coming. Or sometimes you can utilize the slow times to retool your product line and spend more on product research, if you know that you have the cash allocated for that. You can also offer different or ‘specialty’ services to help garner more customers or entice new ones to your business when times are quieter for your business.

3. Plan for taxes and emergency expenses

Just like you plan for your slow periods, also plan for any emergency expenses that may arise. I think this should hold true in regards to your personal finances as well, however, make sure to have money put away for a potential ‘rainy day.’ I think this new normal has taught us that you never know what will come your way and affect your business in ways you never thought possible. Be sure to plan your assets accordingly and don’t think “that will never happen to me.”

4. Add additional products or services

This pandemic has shown the adaptability of many companies who want to not only help essential workers but also keep people safe while out of quarantined. Companies who make apparel were now selling masks or protective wear, or for some, they donated a mask to every purchase that was made during this difficult economic time. While their normal product sales had gone done, their ability to add additional products that were needed not only assisted in keeping their profits up but also helped a worthy cause.

5. Make informed decisions about debt and equity financing

Debt will enslave you is a saying I have heard my family say. That is no doubt true, especially if you don’t properly pay it off or go above your means in what you can take on. Be sure to understand the debts you are putting yourself into when you choose to open a business. Work with financial professionals or seek their advice to get the best and most honest advice on what your options are in regards to loans and financing them for the future.

As mentioned earlier, Brightflow AI is a brand new product that will utilize your Amazon & Shopify sales and Quickbooks, Google Ads & Facebook Ads data to provide simple revenue & ad spend information (without a lot of work on your part), along with cash flow forecasting in real-time and presented in an easy-to-understand way. They also forecast issues before they get out of control for your business.

You can check them out here. They are also offering a Free Access using this link if you want to give it a risk-free trial to see if it’s right for your business. You have nothing to lose by trying a product that’s all identifying short-term problems for long-term success.

Pingback: 5 Ways to Successfully Manage Cash Flow in Your Business | Urban Bluprint