For over 13 seasons ABC’s Shark Tank has been a hugely popular show that has given entrepreneurs the opportunity to land capital from 6 successful investors. The show is entertaining and inspiring as viewers watch entrepreneurs take a crucial step forward in seeing their dreams become a reality. The panel of investors includes a variety of personalities including billionaire Mark Cuban and FUBU clothing founder Daymond John. One of the most well-liked investors is “Queen of QVC”, Lori Greiner.

Known as “The Warm Blooded Shark”, Lori Greiner, grew up in Chicago, Illinois. She briefly worked for the Chicago Tribune while still in college. But her life changed when she invented an earring organizer that helped store and organize jewelry.

This earring organizer went on to make sales of over $1 million within a single year and instantly sold out on the Home Shopping Network. She has since gone on to develop hundreds of products for men and women and is a holder of 108 patents both in the US and abroad for her accessory, organization, and kitchen products.

Now, Greiner’s net worth is over $150 million and she is still helping create products that make millions. In this article, we will list all of Lori Greiner’s investments. We’ll also look at what happened to some of them after a deal was made.

Lori Greiner’s Shark Tank Investments

Scrub Daddy

Deal: $200,000 for 20% equity

Scrub Daddy is considered the most successful product that has ever appeared on Shark Tank. During what is considered one of the best shark tank episodes, Aaron Krause pitched a reusable sponge in the shape of a smiling face that gets firm in cold water and soft in warm water. Krause was only able to gross no more than $100,000 before appearing on the show.

Greiner offered a 20% stake in the company for $200,000 investment. The deal turned out to be the best decision Lori has made in the tank.

This great company has done $400 million in retail sales in just 9 years since airing on Shark Tank! Scrub Daddy has also expanded. The company now has 48 new products and are in 30,000 + retail stores and sold in 17 countries.

Squatty Potty

Deal: $350,000 for 10% equity

Another great investment made by Lori was Squatty Potty. The invention is a stool that helps facilitate good posture when using the toilet. The idea seems simple and is actually recommended by some doctors as a way to help relieve constipation. Within 3 months of the episode airing, the product went on to make $12 million in sales.

Squatty Potty has now done $222 million in retail sales in just 7 years since airing on Shark Tank making it one of the most successful products ever featured on the show.

Bantam Bagels / Bagels Stuffins

Deal: $275,000 for a 25 percent stake

Bantam Bagels (later rebranded as Bagels Stuffins) is a company that created fresh New York-style mini stuffed bagels that could be sold in stores. Nick and Elyse Oleksak founded the company in 2013 by opening a bagel shop near the West Village in Manhattan.

After landing the deal with Lori, the company has sold over $40 million in retail sales in just 7 years. Now, the mini stuffed bagels are sold in Starbucks nationwide and over 16,000 retail stores. This is one of the most successful food products the Shark Tank has ever seen..

The company was recently acquired by T. Marzetti.

Qball

Deal: $300,000 for 30% equity (split with Mark Cuban & Rohan Oza)

The Qball is made of a light, soft, and durable foam, designed to take a beating. The microphone automatically shuts off while in flight so you don’t get any unwanted thumps or bumps over the speakers. The ball is designed for events, conferences, classrooms, and audience engagement.

This throwable microphone ball has sold $3.9 million in retail sales in just 2 years since airing on Shark Tank.

Phone Soap

Deal: $300,000 for 10% equity

The Phone Soap UV Phone Sanitizer & Charger all in one. Cell Phones have been found to contain viruses and germs that may make people sick. The company claims that phones contain 18% more bacteria than public restrooms. This is also a concern for students who use their phones more often than adults. This company has sold over $150 million in retail sales in 7 years.

EverlyWell

Deal: Cheek $1,000,000.00 line of credit with 8% interest for a 5% equity

Julia Cheek founded the Austin-based company called EverlyWell in 2015. EverlyWell is a convenient and discreet at-home testing product with physician-reviewed results in just days. Cheek went into the tank looking for a million dollar investment and she got it for just 5% equity.

The company has sold $300 million in retail sales in just 4 years since airing on Shark Tank. Now, they have created over 30 kits for the most common tests – General Wellness, Energy & Weight and Women’s and Men’s Health.

The Pizza Cupcake

Deal: $125,000 for 12.5% equity and 2.5% advisory shares.

The Pizza Cupcake company was started by chef Andrea Meggiato and his wife Michelle. The business specializes in producing delicious pizza cupcakes. They initially went into the Shark Tank looking for $125,000 in exchange for 5% equity but eventually got a deal made with Lori for 12.5% equity and 2.5% advisory shares.

The company has done $2.7 million in retail sales in less then a year since airing on Shark Tank. The flaky snacks have had rave reactions from celebrities like Drew Barrymore and Mariah Carey who calls them “The king of the pizza cupcake”.

Cup Board Pro

Deal: $100,000 for 20% stake (Matt Higgins, Daymond John, Kevin O’Leary, Lori Greiner, Mark Cuban)

Cup Board Pro was invented by Keith Young, a New York City fireman and chef, in 2010. In 2015, Young was diagnosed with a 9/11 related cancer from working at Ground Zero. His family, Christian, Kiera and Kaley Young, wanted to honor his legacy by continuing to future his invention.

The family was able to land a deal with Matt Higgins, Daymond John, Kevin O’Leary, Lori Greiner and Mark Cuban. The sharks committed to donating their profits to charities for firemen who became ill after responding to the 9-11 attacks. Cup Board Pro has generated $6 million in retail sales in just 3 years since airing on Shark Tank.

SwiftPaws

Deal: $240,000 for 6% equity

SwiftPaws is a remote control toy that gives dogs an opportunity to exercise and stimulation. Within the 24 hours following the initial air date, the company did $100,000 in sales and sold out of its inventory.

AIRA

Deal: $500,000 for 15% stake (split with Kevin O’Leary, Robert Herjavec)

Aira manufactures the world’s first most innovative “free positioning wireless charging pad”. With it, you can charge multiple devices at a time, and place them anywhere on the pad. Lori split this deal with fellow sharks Rober Herjavec and Kevin O’Leary.

Spark Charge

Deal: $1,000,000 for 10% equity and 4% advisory shares (split with Mark Cuban & Lori Greiner)

Chris Ellis And Josh Aviv pitched their company SparkChange to the sharks seeking $1 million for just 6% equity. SparkChange sells portable and ultra-fast EV charging: Charge fast, charge safe, charge anywhere! The future of EV charging is portable.

With the rise of EV around the world, the demand for a way to conveniently charge them will also increase. This portable charging system generates 15 miles of range in just 15 minutes. That’s 8 times faster than standard wired charging stations.

EggMazing

Deal: $350,000 for 10% equity + $2 royalty on each unit sold

Deal: $350,000 for 10% equity + $2 royalty on each unit sold

Curtis McGill and Scott Houdashell pitched their Easter Egg decorating kit during season 9 The fun pitch included one of the men wearing an Easter Bunny suit. The 2 men sought to give 7% of their company for an investment of $350,000.

During the pitch, Barbara Corcoran asks about pre-orders for the following Easter, Scott explains they have $1.2 million in purchase orders. This piqued the interest of all of the sharks on the panel. The entrepreneurs eventually landed a deal with Greiner for $350,000 and a 2% royalty on each unit sold after she offered to give half her royalties to a charity of Curtis and Scott’s choice.

This company has sold $12 million in retail sales during the first year after appearing on the show.

Fish Fixe

Deal: $200,000 for 25% equity

Emily Castro and Melissa Harrington created their company Fish Fixe to help more people eat healthy seafood. Fish Fixe sources premium seafood that contains more chemicals, GMOs, or antibodies and delivers them right to your home.

Kevin O’Leary seemed to be the best shark for this deal since it would fit right in with his “Chef Wonderful” brand. However, right before he was able to close the deal, Greiner swooped in and offered less equity than O’Leary.

Instafire

Deal: $300,000 for 30% equity (Split with Mark Cuban)

Insta-Fire is a safe, simple, and versatile product that starts fires quickly. Insta-Fire is designed to safely light campfires, prepare charcoal briquettes, or as a safe and reliable fuel source for cooking while camping or in emergencies.

FlexScreen

Deal: $400,000 for 50% Of Retail Business + $400,000 Line Of Credit in FlexScreen

Joe Altieri went into the shark tank hoping to land a deal for his innovative window screens. FlexScreen is a patented window screen that can be squeezed and popped into place. He was seeking $800,000 for 6% equity. His pitch initiated a bidding war between Greiner, Barbara Corcoran, and Kevin O’Leary.

Altieri eventually accepts Greiner’s offer because he feels that she has better connections in the hardware space. Since then, the company has done $2 million in retail sales in just 2 years since airing on Shark Tank.

Bambooee

Deal: $200,000 for 10% equity

Bambooee is a reusable paper towel made from rayon bamboo. This product is environmentally-friendly as 1 roll can replace 286 paper towel rolls. The company has sold over $10 million in retail sales in just 5 years since airing on Shark Tank.

Souper Cubes

Deal: $400,000 for 5% equity

Souper Cubes is a kitchen product that allows you to freeze and store your leftovers in perfect sized portions. Jake and Michelle Sendowski were seeking $400,000 for 5% equity. During their pitch received offers from Kevin O’Leary, Barbara Corcoran, along with Greiner.

They left the tank with the $400,000 they were seeking and the exact amount of equity they were offering. Souper Cubes has gone on to make $2 million in retail sales in just 2 years since airing on Shark Tank.

The Frozen Farmer

Deal: $125,000 for 30% equity

This Frozen Farmer company has done $6.5 million in retail sales in just 1.5 years since airing on Shark Tank. Frozen Farmer creates allergen-friendly ice cream and sorbet. They also create frobert (a blend of ice cream and sorbet that has less fat, calories and sugar content than traditional sorbet) from the fruit grown on their family farm.

GoodHangups

Deal: $100,000 for 10% equity if paid back within a year otherwise 20% equity

GoodHangups magnetic product that you can stick to your wall to hang up pictures, posters, and other lightweight objects. If you decide you want to take it down, you can easily peel the magnet off the wall without leaving any stains behind.

When Founder Leslie Pierson pitched the idea, she reported that GoodHangups had $450,000 in sales over the past 12 months. All of the sharks were impressed but it was Greiner who won the deal seeing an opportunity to sell the product on QVC.

Since appearing on the show, GoodHangups has made $5.3 million in retail sales in just 3 years.

The Baby Toon

Deal: $50,000 for 50% equity

This product that was designed by 7 year-old Cassidy Crowley, is a soft silicone baby spoon that eliminates sharp angles and ends making eating safer and easier for babies. Crowley decided to create the spoon as a project when she noticed that her mother would get nervous when feeding Cassidy’s baby sister with a traditional spoon.

Crowley impressed the sharks with her pitch. Lori Greiner was especially impressed. So much so that Lori jumped in and offered Cassidy the $50,000 for the 50% equity asked. The Baby Toon recently landed a deal with baby brand Munchkin.

Scholly

Deal: $40,000 for 15% equity (Daymond John and Lori Greiner)

Scholly is a mobile and web app that allows high school students, current college students, and graduate students to easily find scholarships to pay for college. This is an app that plans to help millions of high school students who are looking for a way to help pay for the rising cost of a higher education

Scholly looks to reduce the number of unclaimed scholarships by streamlining the process of locating and applying for scholarships. Christopher Gray was able to land a deal with Daymond John and Lori Greiner for $40,000. The company has done $11 million in retail sales in just 7 years since airing on Shark Tank.

The Better Bedder

Deal: $150,000 for 18% equity

The Better Bedder acts as a headband that fits around any mattress that makes making your bed easier. Judy Schott and Nita Gassen were seeking $150,000 for 10% of their bed making product. After their pitch, the ladies had the interest of Daymond, Barbara and Lori.

Both Greiner and Barbara Corcoranoffered the entrepreneurs $150,000 for 18% with Greiner stating that she was going to get the product featured on QVC. The entrepreneur team accept Lori’s offer even after Corcoran offered to lower her equity to %15.

KIN Apparel

Deal: $200,000 for 30% equity ( Lori Greiner & Emma Grede)

Kin Apparel, specializes in gorgeous and functional apparel and accessories all while protecting your hair. They design sweatshirts with satin-lined hoods designed to prevent frizz, retain moisture and fit a variety of hairstyles to satin pillowcases.

Mensch on a Bench

Deal: $150,000 for 15% equity (Lori Greiner & Robert Herjavec)

Mensch on a Bench is the version of the wildly popular Christmas Elf on the Shelf. Moshe the Mensch tells the story of Hanukkah and is designed to bring families together for Hanukkah and promote the values of being a Mensch or good person.The company has sold over $7 million in retail sales in just 5 years.

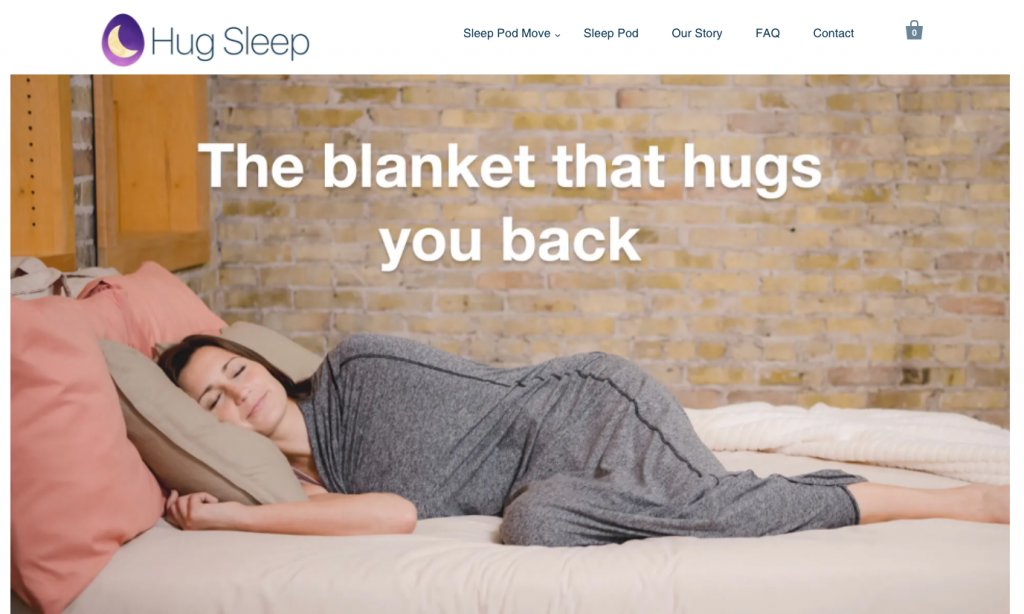

Hug Sleep

Deal: $300,000 for a 20% stake (split with Mark Cuban)

Hug Sleep is a sleep-aid designed around the science of Deep Touch Pressure Therapy that can help you fall asleep faster, and stay asleep longer by applying a gentle, calming pressure to your entire body, much like a hug. The aim is to help to reduce anxiety to offer a better night’s sleep.

The company has done $8 million in retail sales in just 1 year since airing on Shark Tank.

Drop Stop

Deal: $200,000 for 20% equity

Drop Stop is a device designed to prevent items from falling between a car’s front seats and center console. The product helps prevent driver distraction if something were to fall in the space in between their seat and the console. Since airing on Shark Tank 9 years ago, the company has sold $60 million in retail sales.

Kettle Gryp

Deal: $300,000 for 15% equity

Kettle Gryp is a portable dumbbell adapter that turns ordinary dumbbells into dynamic workouts. Kettle Gryp is designed to be an addition to any home gym, traveler, or trainer/gym owner with limited space. The product offers full kettlebell workout at a range of weights. All the user needs is to find a dumbbell.

Goverre

Deal: $200K for 33.3% stake (Mark Cuban and Lori Greiner and Robert Herjavec)

GOVERRE is a GLASS, portable, stemless wine glass with a silicone sleeve and drink-through lid. With GOVERRE, you can now bring your favorite glass of wine with you. GOVERRE is not going to spill your wine.

Goverre has sold $4.6 million in retail sales in just 2 years since airing on Shark Tank.

Signal Vault

Deal: $200,000 for 25% equity (Lori Greiner & Robert Herjavec)

SignalVault is a RFID Blocking Credit & Debit Card Protector. The product is designed to protect the carrier’s personal information from Crowd Hacking. Signal Vault has done $3 million in retail sales in just 4 years since airing on Shark Tank.

NightCap

Deal: $60,000 for 25% stake

This product is designed to prevent drink spiking. NightCap is placed over a drink to cover it to stop anyone from tapering with the beverage. When not in use, the cover doubles as a hair scrunchie, so can easily be worn on wrist or in hair.

Simply Fit Board

Deal: $125,000 for 18% equity

This product is a balance board that is designed to help individuals exercise and shape. The company has sold $160 million in retail sales in just 6 years and is sold in 50,000 retail stores.

Grypmat

Deal:$360,000 for 30% equity (Lori Greiner, Mark Cuban and Richard Branson)

Invented by an Air Force mechanic, Grypmat is a line of products designed to house tools.

Their products are designed to increase efficiency, safety and productivity. The high friction surfaces allow tools to be placed where the work is being done and helps reduce FOD and overall maintenance time while increasing aircraft longevity.

Grypmat has sold $2.8 million in retail sales in just 2 years since airing on Shark Tank.

ScreenMend

Deal: $30,000 for 50% equity

ScreenMend is a screen repair kit invented by Brian Hooks, and his daughters Lily & Emma. They came up with the idea while helping to clean up the family’s screen porch. The company has sold $18 million in retail sales.

Bug Bite Thing Suction Tool

Deal: $150,000 for 10% equity

Bug Bite Thing Suction Tool is a chemical-free solution that alleviates the stinging, itching and swelling caused by insect bites and stings. It works by using suction to remove the insect saliva or venom left underneath the skin. By removing the irritant, the body stops reacting. Unlike topical creams and ointments, the problem is eliminated, not masked. The other cool thing is that it is reusable.

This was one of the rare times that Greiner offered up her “golden ticket”. This is ticket she offers to an entrepreneur for the exact money they asked for and the amount of equity they requested.

SwipenSnap

Deal: $120,000 for 50% Equity (Kevin O’Leary and Lori Greiner)

This patented one-hand cream applicator allows you to easily apply diaper cream, sunscreen, lotion or any kind of cream with just one hand.

Tangle Pets

Deal: $75,000 for 50% stake

Tangle Pets combines a plush toy with a functional hair brush. The product is designed for kids to use and to encourage children to brush their hair. The company has done $12 million in retail sales in just 2 years since airing on Shark Tank.

Fiber Fix

Deal: $120,000 for 12% equity

Spencer Quinn and Eric Child pitched their invention Fiber Fix during season 5 of Shark Tank Fiber Fix is a super strong tape that they claimed was Fiber Fix 100 times stronger than duct tape.

They were able to land a great deal with Greiner for just 12% of their company. The company has generated $50 million in retail sales since appearing on Shark Tank.

Sleep Styler

Deal: $75,000 for 25% equity

Sleep Styler is a heat free hair drying and curling tool that curls hair while you sleep, saving you the time and effort of curling and damaging hair with an iron. Tara Brown was a San Diego ophthalmologist who came up with the product. Since appearing on Shark Tank, Sleep Styler has sold $50 million in retail sales in just 2 years since airing on Shark Tank.

Biaggi

Deal: $500,000 for 33% stake

Biaggi sells an entire line of folding luggage.The most notable product they offer is a four-wheeled carry-on bag that stores easily under a hotel room bed and takes up less space in closets in the home.

Stephen Hersh went into the shark tank seeking $500,000 for 30% of his company. He eventually landed a deal with Greiner for 33%. Biaggi has $13.5 million in retail sales in just 5 years since airing on Shark Tank.

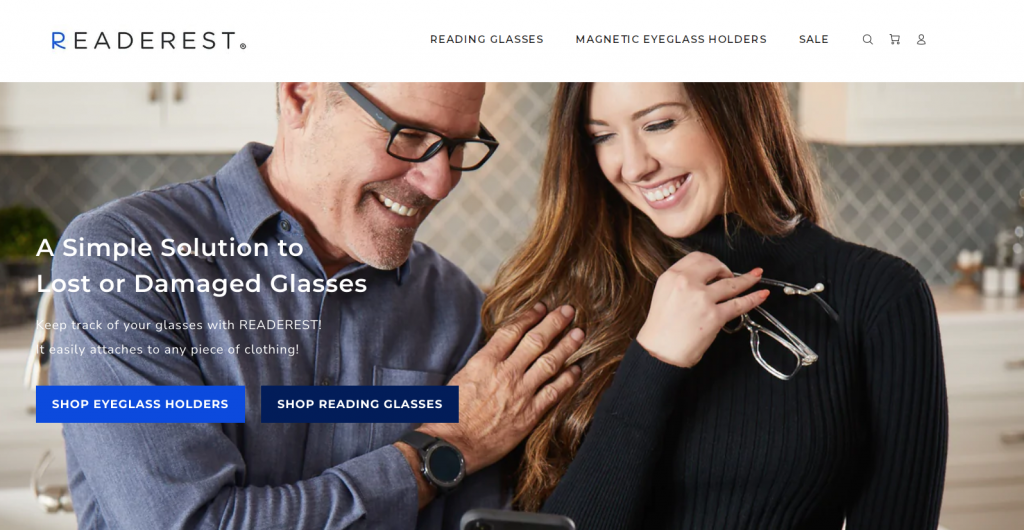

ReadeREST

Deal: $150,000 for 65% equity

In Season 3, Lori invested in the company that solved the problem of missing and scratched glasses. After habitually losing and damaging his glasses, Rick Hopper began using paperclips and magnets to keep his glasses protected. He later developed a prototype product, bought a patent, and started displaying his invention at tradeshows.

Essentially giving Lori the entire company, Hopper agreed to accept $150,000 for 65% of his company. However, it seems to be paying off as the company has grossed more than $8 million in sales. Readerest is a popular item on QVC and is often sold out.

Hugo’s Amazing Tape

Deal: $100,000 for 100% entire company (Split with Mark Cuban)

This product is a no-adhesive, self-clinging transparent tape that you can use for almost anything from arts and crafts for wrapping around spools of thread to jumbling cable cords for household use.

Sisters Kathryn Saltsburg and Lauri Frasier pull at the heartstrings of the Sharks by telling them that Hugo’s Amazing Tape was their father’s legacy. After hearing this, Mark Cuban and Lori Greiner offered to buy the entire company with the promise that they will take good care of Hugo’s legacy.

CordaRoy’s

Deal: $200,000 for 58% equity

Why? CordaRoy’s are comfortable bean bag chairs that converts into a bed. They have over 100 sizes and color combinations. The company has sold $48.8 million in retail sales in just 6 years since airing on Shark Tank.

Safe Grabs

Deal: $75,000 for 25% stake

Safe Grabsis BPA-free and safe to use in your microwave and anywhere in the home. It has a specially designed circular shape that fits perfectly on your microwave turntable and allows you to safely grab hot dishes without burning your fingers.

The company has done over $5 million in retail sales in just 3 years since airing on Shark Tank.

Pricetitution

Deal: $100,000 for 40% equity (Split with Rohan Oza)

Pricetitution is a card game where you guess how much money it would take your friends to do absurd things. This game is all about you, your friends, and the ridiculous conversations you’re already having.

Pingback: 5 Best Shark Tank Episodes for Students - StartUp Mindset

Pingback: Run Your Online Enterprise Following these Cutting Edge Tactics To Make You Invincible ·

Pingback: OMG! The Best BUSINESS Ever! ·

Pingback: Here are All of Lori Greiner’s Shark Tank Deals and How Well they are Doing. – Joseph O'Dierno Buffalo