Small businesses are the backbone of the U.S. economy, accounting for over half of all private sector jobs. As such, business growth is essential for overall economic prosperity and for industries to remain competitive and stay ahead of the curve.

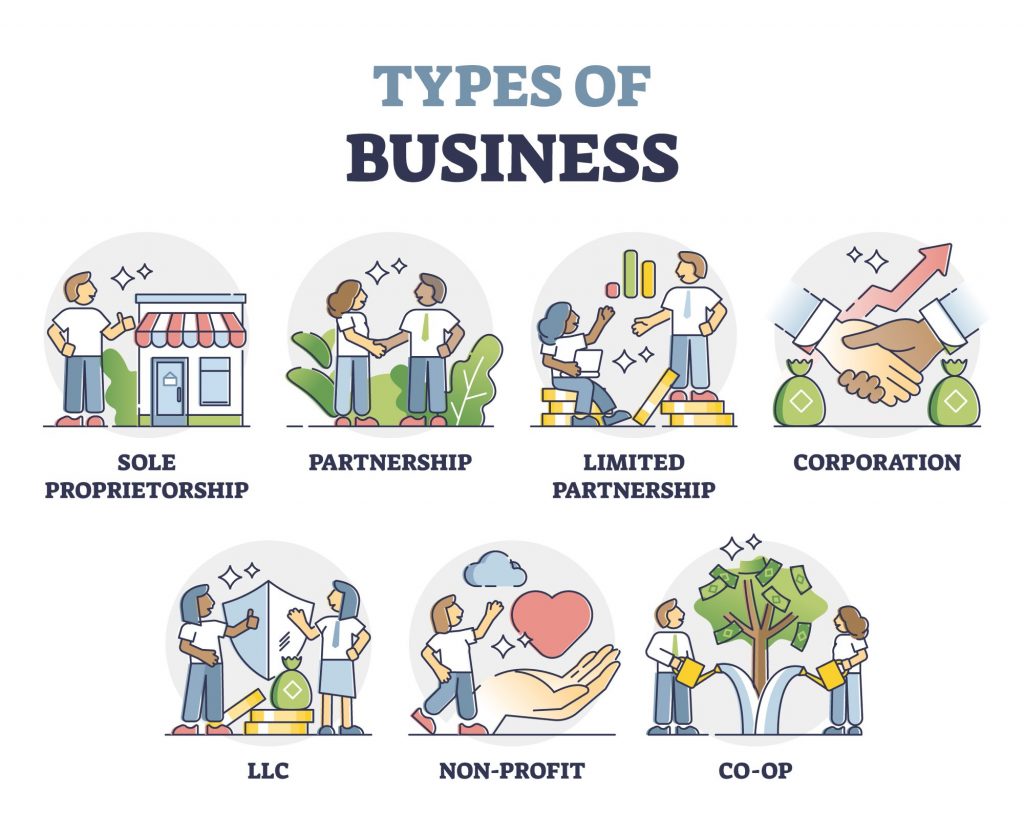

However, before a small business can experience growth, it must establish a legal structure. A legal structure is a framework that governs the operations of a small business. There are four main types of business legal structures, and they are:

- Sole Proprietorship

- Partnership

- Corporation

- Limited Liability Company (LLC)

Each type of structure has unique requirements and needs. For example, the details on how to start a LLC in NC are different from starting a Partnership, Corporation, or Sole proprietorship in the same state.

This article looks at the six different types of legal structures and how they affect the operations and growth of a small business. Keep reading to learn more

Definition Of Small Business Growth

Small business growth is defined as the increase in size, revenue, or market share of a small business. Growth is typically measured in terms of sales, profits, or number of employees. However, it may also be measured in terms of customer satisfaction, brand recognition, and other factors. This generally depends on the priority of the small business owner.

Overview Of Legal Structure

A legal structure is a framework that governs the operations and liabilities of a small business. As mentioned, these structures include a sole proprietorship, partnership, corporation, or limited liability company (LLC). The legal structure determines the legal and financial responsibilities of the business owners and how the business is taxed.

6 Things To Know About Business Growth And Legal Structure

When starting a new business, it’s important to understand the implications of your chosen legal structure. The structure of your business could sometimes limit your plans for expansion. So, it’s important to choose wisely. Below are six things to know about small business growth and legal structure:

Understand Your Business Model

Before you can begin to grow your business and implement the right legal structure, you must understand the business model and the goals for your business. Knowing the purpose of your business and the product or service you are offering will help you determine the best legal structure for your business.

Research Each Business Structure

Each business’s legal structure has strengths and weaknesses. As an entrepreneur, you have to consider your business plans and vision to choose an appropriate structure that is not just suitable for your business’s current needs but is also flexible enough to accommodate your future plans. Therefore, it’s essential to understand the different types of legal structures. A brief description is provided for each type below:

Sole Proprietorship

A sole proprietorship is the simplest and most common type of business structure. It’s owned and operated by one person responsible for all liabilities and taxes. The main advantage of a sole proprietorship is that it is easy to form and manage, with no additional paperwork required.

This makes it an attractive option for small businesses that do not have the resources or expertise to form more complex legal structures. In addition, sole proprietorships offer the benefit of pass-through taxation, meaning that all income and losses are reported on the owner’s tax return.

However, the owner of a sole proprietorship takes on personal responsibility for the business’s debts and obligations. Thus, the owner’s assets could be in jeopardy in a financial disaster. The availability of funding and capital is also restricted for sole proprietorships. This can limit a small business’s growth potential.

Partnership

A partnership is a business structure that could be owned by two or more owners. The responsibilities of the firm, as well as its taxes, are the joint responsibility of the partners. The business must also register with the state and submit a partnership agreement to operate lawfully.

Partnerships offer several advantages for small businesses. They are relatively simple to establish and operate, and the partners can share the profits and losses. In addition, partnerships offer the benefit of pass-through taxation, meaning that all income and losses are reported on the partners’ tax returns.

The downside of a partnership is that every member is personally responsible for the partnership’s obligations. Because of this, the partners’ assets could be at stake if the company fails. Furthermore, all business decisions must be agreed upon by the partners, which could cause conflicts in the management and operations of the business.

Corporation

A corporation is a more complex business structure that requires filing Articles of Incorporation with the state. A corporation is owned by shareholders and managed by a board of directors. In this structure, the shareholders are not personally liable for the business’s liabilities and taxes.

There are many benefits that corporations can provide for start-ups. By definition, shareholders are shielded from the company’s debts and liabilities because corporations exist in their own right and are legally distinct from their owners. Incorporating a business is smart because it allows you to pool resources, reduce risk exposure, and switch ownership with relative ease.

The main disadvantage of a corporation is that it is subject to double taxation, meaning that the business profits are taxed twice: once at the business level and once at the individual level. Additionally, corporations are more complicated to form and require more paperwork and compliance with state laws.

Limited Liability Company

A limited liability company (LLC) is a hybrid business structure that features the liability protection of a corporation and the flexibility of a partnership. This type of structure is owned and operated by members who are not personally liable for the debts and liabilities of the business.

The advantages of an LLC include limited liability for the members, pass-through taxation, and the ability to be managed by a hired manager. The LLC can also enter into contracts and own property under its own name.

Compared to other business structures, the biggest drawback of an LLC is the increased administrative burden and legal scrutiny that comes with operating under its name. In addition, the profits of an LLC are subject to double taxation.

Consider Your Tax Obligations

The legal structure you choose for your business can significantly impact your tax obligations. While the IRS does not require you to choose a particular structure, it is important to understand each structure’s impact on your taxes.

Being a sole proprietor, for example, will only require you to file an individual return since you will be classified as a self-employed person for taxation purposes. A corporation, however, is required to file tax returns as a corporate body. Owners of a corporation are still required to file their taxes individually.

Consider Your Long-Term Goals

When choosing a legal structure, it’s important to consider your long-term goals for the business. For example, a corporation or LLC may be the better option if you plan to take on investors in the future. On the other hand, a sole proprietorship or partnership may be the better option if you are the sole owner and don’t plan to take on investors.

Seek Professional Guidance

It is important to remember that the decisions you make regarding the legal structure of your business can have long-term implications. It is a good idea to seek professional guidance to ensure that you make the right decision. An experienced attorney can help you understand each structure’s legalities and the potential tax hacks associated with each option.

Keep Up With Changes

The legal landscape is constantly changing, and it is important to stay up-to-date on any changes that might affect your business. Make sure to regularly consult with your attorney and review any changes to the law that could impact your business.

It’s important to consider all your options when selecting the legal structure for your business. Taking the time to understand the legal structure of your business can help ensure that it is set up for success and growth.

Summary

Small business growth and legal structure are important topics that all business owners should understand. Choosing the right legal structure for a small business is an important decision that can significantly impact the direction and growth of a business. Different legal structures offer different advantages and disadvantages that can influence management and expansion. Following these tips can create a strong legal foundation for your business and help ensure continued growth. Doing so can go a long way toward ensuring the success of your small business.

Pingback: Small Business Growth And Legal Structure: 6 Things To Know – Joseph Odierno Buffalo